Standard Solution June 2024 - Release notes

Released: July 1st, 2024

The Standard Solution June 2024 release introduces a new market and reference data connection to Keldan, trading integration with KODIAK Oms, as well as other smaller improvements and fixes.

Market and security reference data connection to Keldan

Why?

This feature was implemented to enable our clients to get market data and security reference data for Icelandic securities.

Who is this for?

This feature is for everyone who wants to get market data and security reference data for Icelandic securities.

Details

The connection functions similarly to other market and security reference data connections in FA Platform. A separate agreement with Kodi is required. Once the connection is established, you can obtain the market or reference data for Icelandic securities from Keldan.

Learn more: Set up Keldan market data connector in FA User guide.

Trading integration to KODIAK Oms

Why?

This feature was introduced to hekp our clients trade domestic equities and bonds in the Icelandic market.

Who is this for?

This feature is for everyone who wants to trade domestic equities and bonds in the Icelandic market.

Details

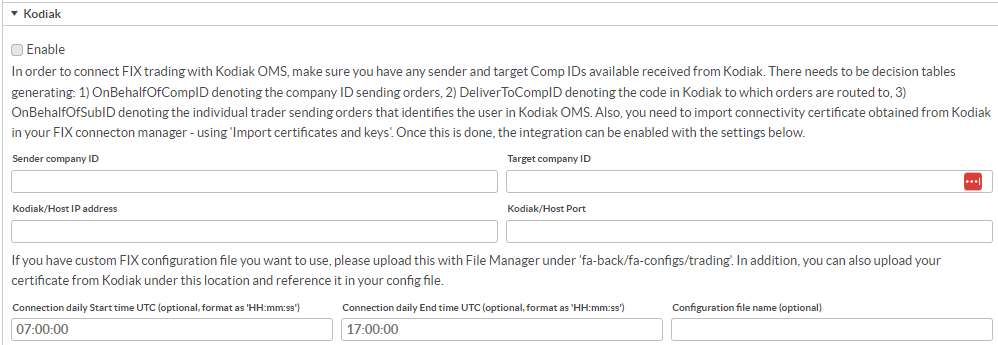

KODIAK Oms is an execution and order management system. KODIAK Oms users can manage the full trading life cycle - from capturing client instructions and placing orders on the market to back-office allocation. FA platform provides integration to KODIAK Oms, and, through their service, a direct market access to Nasdaq marketplace in Iceland. Integration to KODIAK Oms is done using the FIX protocol and supports trading Icelandic equities and bonds.

The integration functions similarly to other trading integrations within FA, where the connection is used for order staging (preparing and organizing a trade order before market execution).

To set up the connection, configure the necessary details in Tools → Administer → Trading connectors → Manage.

Other improvements

Market Data Connector

The Refinitiv market data connector now allows users to specify the days of the week for price fetching. This feature enables the users to limit the number of days prices are retrieved, thereby reducing costs.

The EOD market data connector now imports equities traded in pence with the currency GBP using a multiplier of 100, just like our other market data connectors.

Accounting

The Deferral of accrued Interest feature now includes an option to incorporate bank accounts. It collects accrued interest for each account individually and assigns the generated transaction to the corresponding account.

External reporting

SIRA reporting now offers an option to calculate prices with more decimal places when configured to use exact pricing. Additionally, it generates an attachment file containing the security codes of excluded securities.

Tax reporting

Swedish tax reporting now supports running in the background, making it useful for processing a large number of portfolios.

The VSAPUUSE and VSTVERIE reports now include validation and prompt the user if security classification is missing when running the reports.

Utilities

The ENABLE.CONFIG.RULES permission has been added to the PRE role. Previously, the PRE role allowed access to Administer decision tables, but users didn't have the rights to Preview Rules, Reload Rules, or Cancel the Process.

Portfolio management

When customers add portfolio or transaction cost type categories, these will now remain unchanged after an upgrade, even if they are standard solution types.

Trade order management

Trade order validation now marks the orders with Order validation - Waiting for cash tag if there is not enough cash in the portfolio's account to execute the order but there is positive cash flow that is settled on a future date. Learn more: Validate trade orders.

Fixes

Accounting

Deferral processes now generate a running sequence number at the end of the transaction reference, ensuring that each one is unique. Previously, the lack of unique references could cause issues.

External reporting

SIRA reporting now utilizes previous date positions and report date prices to accurately calculate the total for the 10 largest unit holders. Previously, it could incorrectly calculate the market value for these holders in certain scenarios.

Tax reporting

The VSTVERIE report can now manage scenarios where two or more portfolios are associated with the same contact and hold fund units for the same fund. It assigns different IDs in field 049 of the report when portfolios are different, ensuring compliance with tax authority requirements.