FA Back 3.25 - Release notes

Released: December 2025

FA Back 3.25 introduces a number of new features and improvements. You can now mark portfolios or positions as pledged, preventing them from being traded. Another important feature is strategy rebalancing that allows you to keep portfolios aligned with target allocation shares. Several improvements have been made to bond management: daily interpolation for bonds tied to CPI indices, repayment schedule for amortizing bonds, face value field for trading bonds. For these and other improvements, see the full release notes below.

Pledging and unpledging portfolios, positions and purchase lots

Why?

Users need to pledge and unpledge portfolios, positions and purchase lots. Pledged positions and purchase lots are restricted from trading, for example, as collateral for a loan or to restrict specific purchase lots from being traded as part of an incentive program. Pledging ensures compliance with agreements and restrictions and helps prevent unauthorized transactions.

Who is this for?

This feature is for users who manage portfolios with pledged positions, for example, as a guarantee for a loan or as part of an incentive program.

Details

The new pledging functionality allows you to mark a portfolio, position, or purchase lot as pledged to prevent it from being traded. You can pledge and unpledge whole portfolios or individual positions and purchase lots that have no pending trade orders to sell, redeem or exchange the units. Pledged positions can still be included in corporate action runs, for example when dividend is paid.

To pledge a whole portfolio, mark the portfolio as pledged in the Portfolio window, Basic info tab. When you need to unpledge the portfolio, remove the pledged status. To allow you to search for pledged portfolios and positions, we added a new column “Pledged” in the Portfolios view and the Positions view.

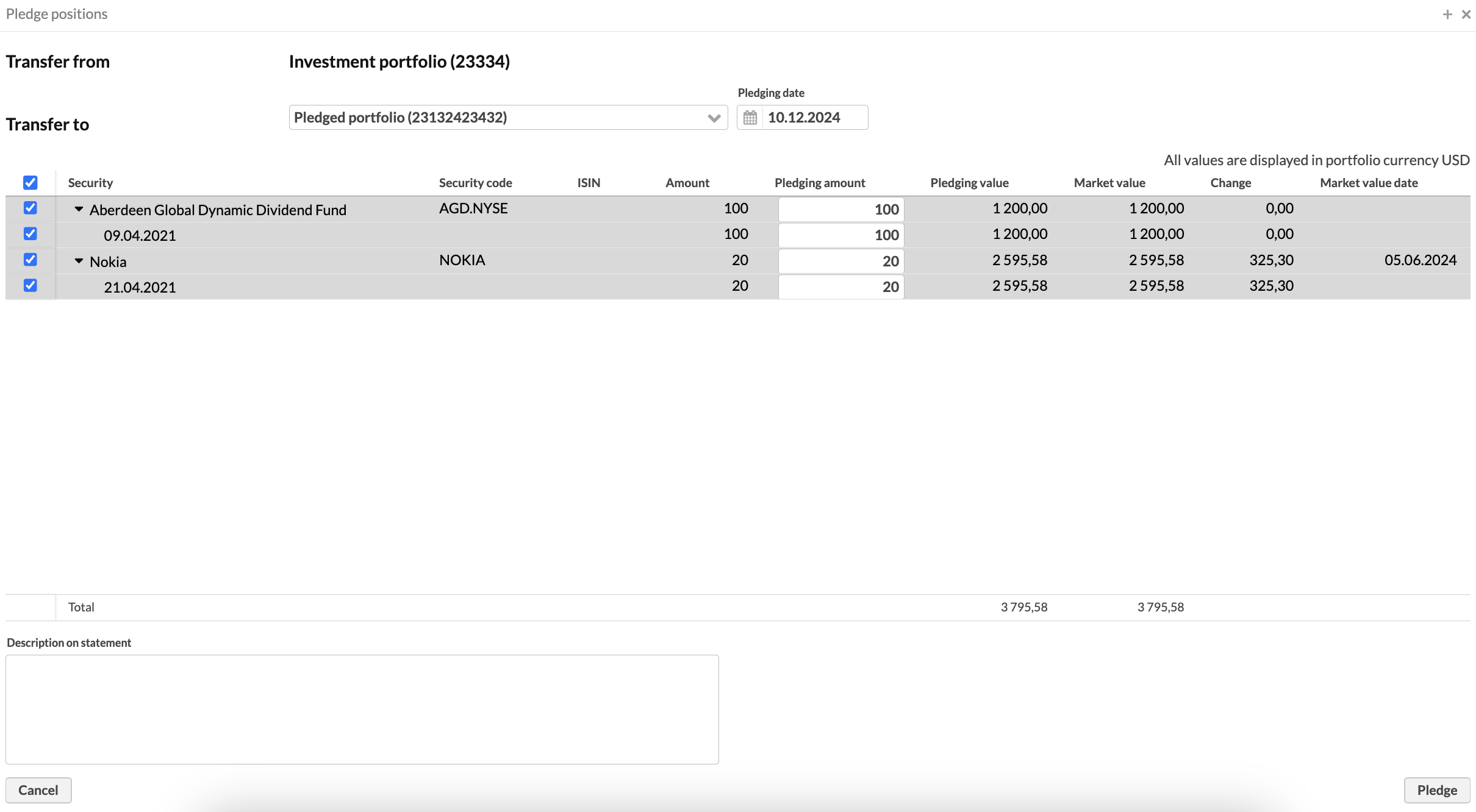

To pledge and unpledge individual positions and purchase lots, right-click the portfolio in the Overview and open the pledging or unpledging window. You can choose the positions or purchase lots and adjust the number of units to pledge or unpledge.

|

|

When you pledge positions or purchase lots, the FA system places them in the portfolio you marked as pledged and blocks transactions and trade orders to this portfolio. The system preserves the history of costs and taxes related to a position.

You can also pledge a portfolio by importing the pledged status in a CSV file. We also added API support for fetching pledging information via GraphQL. You can fetch pledged portfolios, check if a specific portfolio is pledged, and pledge a portfolio with queries.

Learn more: Pledge and unpledge positions, Set up pledging portfolios and positions.

Strategy rebalancing

Why?

Strategy rebalancing enables you to align your portfolio with its target allocations. While rebalancing against a model portfolio or investment plan existed in FA platform before, it wasn’t possible to rebalance a portfolio against a strategy that sets target on the allocation level.

Who is this for?

This feature is for portfolio managers who need to ensure that a portfolio follows target allocation.

Details

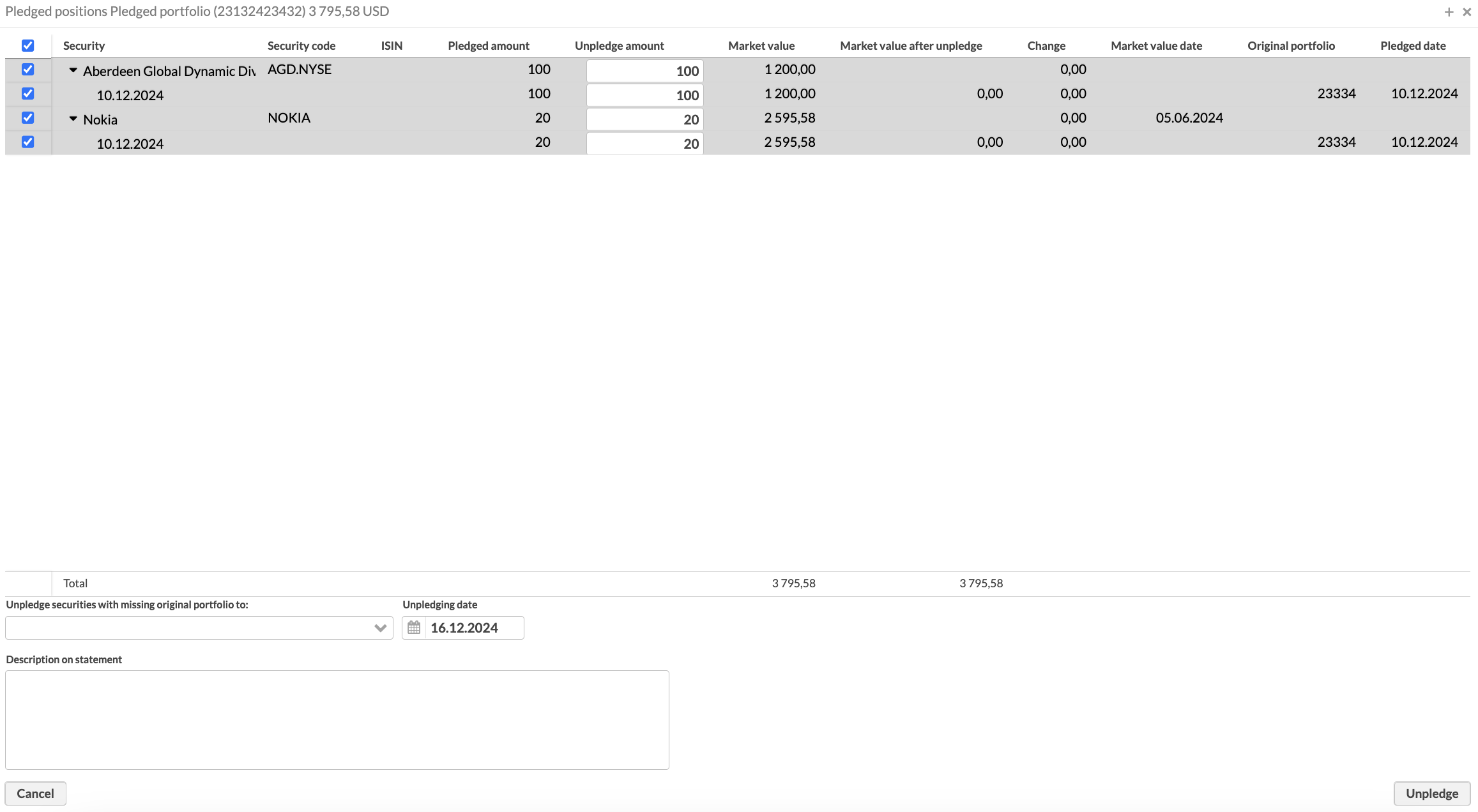

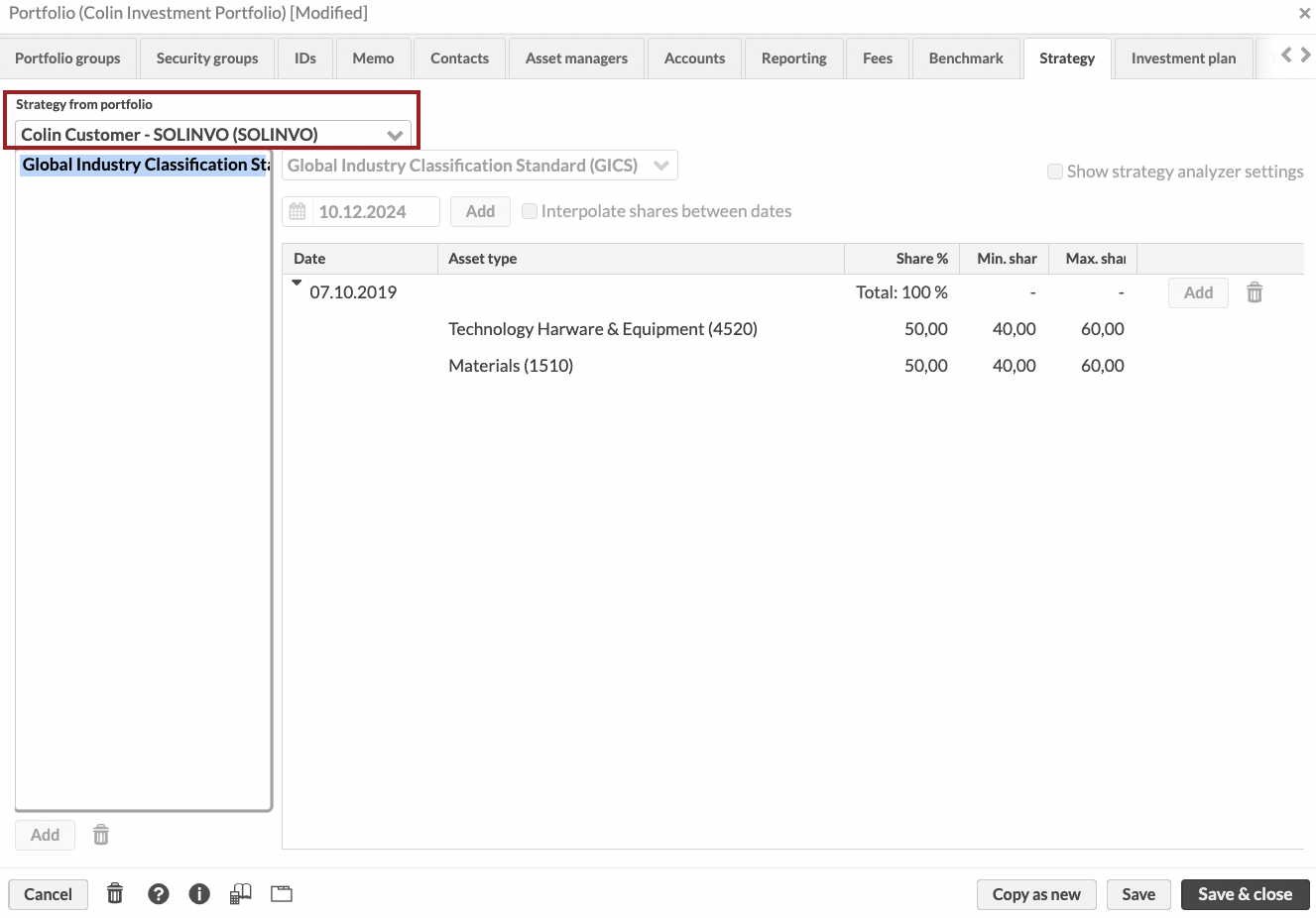

Strategy rebalancing is now selectable in the Rebalance window. If an asset class in the portfolio deviates from the target, the system suggest to increase the positions proportionally to their current shares. If an asset type is missing from the portfolio (for example, the strategy requires 10% Finnish stocks but the portfolio doesn't have any), the system suggests equally-sized trade orders for each security in the missing asset type from your buy list. Strategy rebalancing doesn't adjust holdings within the asset type. For example, if Finnish holdings in the portfolio are represented by one security, rebalancing considers this sufficient. It doesn't suggest sells to buy other Finnish stocks from the buy list. Strategy rebalancing works only for equity portfolios. It should not be used with funds and ETFs that are allocated to several asset types (for example, a fund security can be allocated as 70% US and 30% Canada).

|

Learn more: Rebalance portfolios against a strategy, Rebalance window.

Using the same strategy in multiple portfolios

Why?

Some companies use a set of strategies to define asset allocation in client portfolios, assigning a client portfolio to one or more strategies they have in use. Before, you could only create strategies per portfolio and you couldn’t reuse them. To adjust a strategy linked to multiple portfolios, you would need to edit it in each portfolio one by one.

Who is this for?

This feature is for companies that reuse strategies in multiple clients' portfolios.

Details

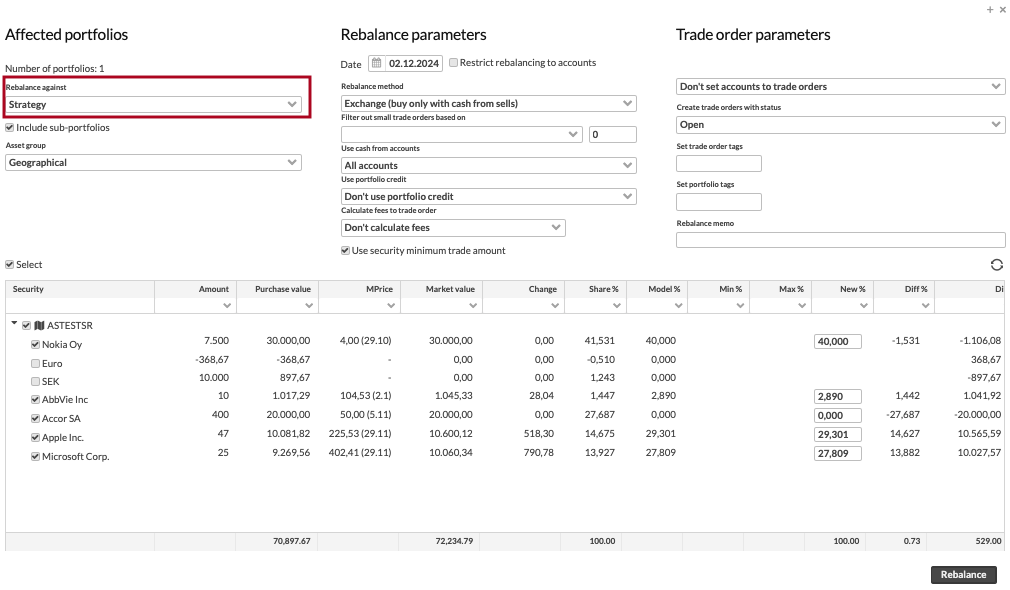

You can now maintain one strategy and reuse it in multiple portfolios, instead of keeping and updating a strategy on every portfolio that you manage. To use a strategy across multiple portfolios, set it once in one of the portfolios: choose the asset group and define the desired portfolio allocation. Then, link the strategy to other portfolios in the Strategy tab that now has a new Strategy from portfolio field. You can also link your strategy to portfolios via the CSV file import.

To update a reused strategy, edit it in the source portfolio – the changes will be applied to all portfolios that reuse it. You can also import the updated strategy to the source portfolio in the CSV file.

If a strategy is reused, it can’t be deleted from the source portfolio.

|

Learn more: Strategy, Portfolio window, File format for importing portfolios.

Daily CPI interpolation for bonds

Why?

Daily CPI calculations are essential for valuating bonds such as Icelandic bonds tied to indices like the NEY (lagged CPI).

Who is this for?

This feature is for the users who manage bonds that require daily CPI interpolation.

Details

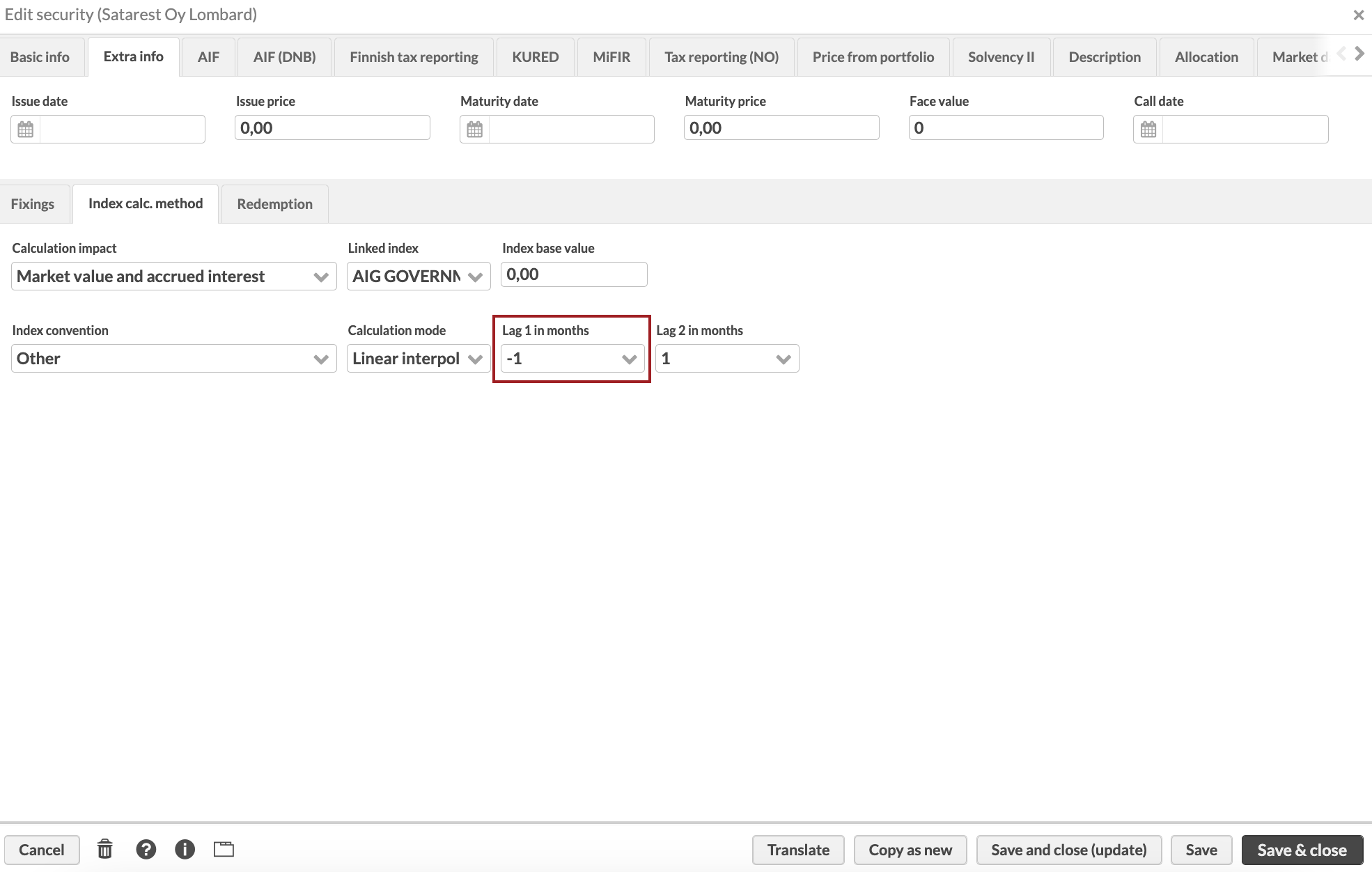

You can now enable CPI interpolation to include the upcoming month’s value, meaning the system calculates instalment and bond price values on any given day. We added a new option “-1” for the Lag 1 in months field in the Security window, Extra info tab which you can select to enable the use of the upcoming month’s CPI value as the endpoint in the interpolation.

The new lag option ensures that bond valuations align with CPI fluctuations for bonds tied to the NEY (for example, Icelandic bonds). This prevents issues in accrued interest and coupon valuations.

|

Learn more: Security window.

Calculate repayments for amortizing bonds

Why?

Amortizing bonds, including housing bonds and index-linked even-payment bonds, are commonly used, for example, in Iceland and the US. For such bonds, the principal is repayed gradually over the life of the bond, along with periodic interest payments. Now, you can calculate repayments for amortizing bonds in FA platform. The feature also serves as a base for upcoming developments, such as redemption corporate action that is based on the defined repayment plan.

Who is this for?

This feature is for everyone who manages portfolios with amortizing bonds.

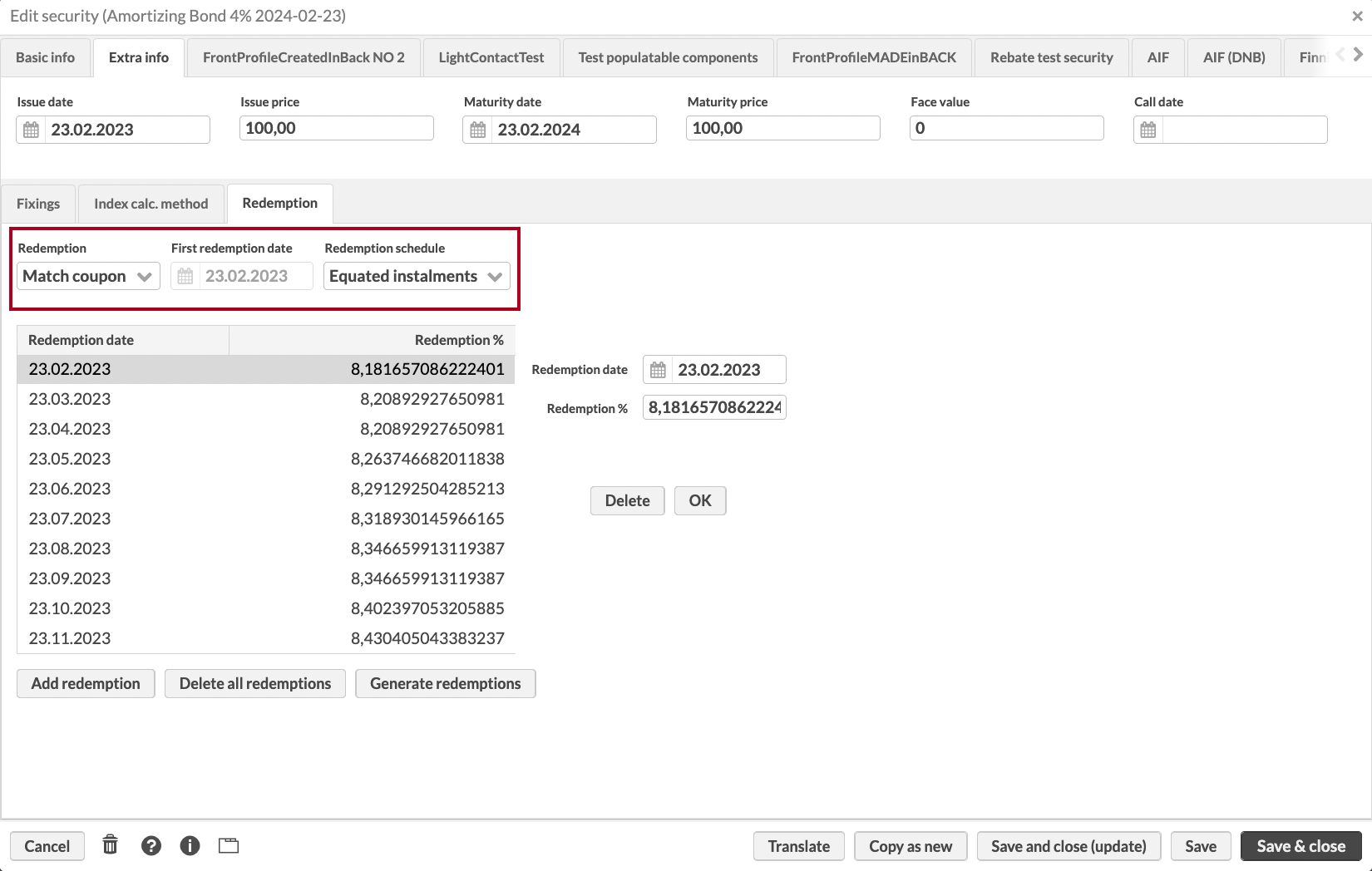

Details

For each period, the bond pays part of the principal and an interest amount calculated based on the remaining principal. The system calculates the interest component using the formula:

Where:

No – Total principal.

r – Interest rate (annual coupon rate divided by the number of annual payments).

n – Total number of coupon payments.

k – Current coupon payment number (for example, k=1 for the first coupon).

You can use one of the following repayment plans:

Equated installments – repayments in equal amounts that include principal and interest.

Straight line – repayments in equal amounts that include principal, interest and the bond’s premium or discount in equal amounts.

The estimated payments are taken into account in the following bond indicators that you can track in the Analytics+ view:

Market value

Yield till maturity

Duration, modified duration

Convexity

|

Learn more: Security window, File formats for importing securities and security prices.

Face value for bonds

Why?

In bond trading, there can be different ways to specify the trade order amount:

Defining the total face value of the bonds to buy or sell.

Defining the number of units, each of them having a certain face value.

For the latter case, the system needs to know face value per bond unit.

Who is this for?

This feature is for the users who store bond details in the FA Platform and trade with bonds.

Details

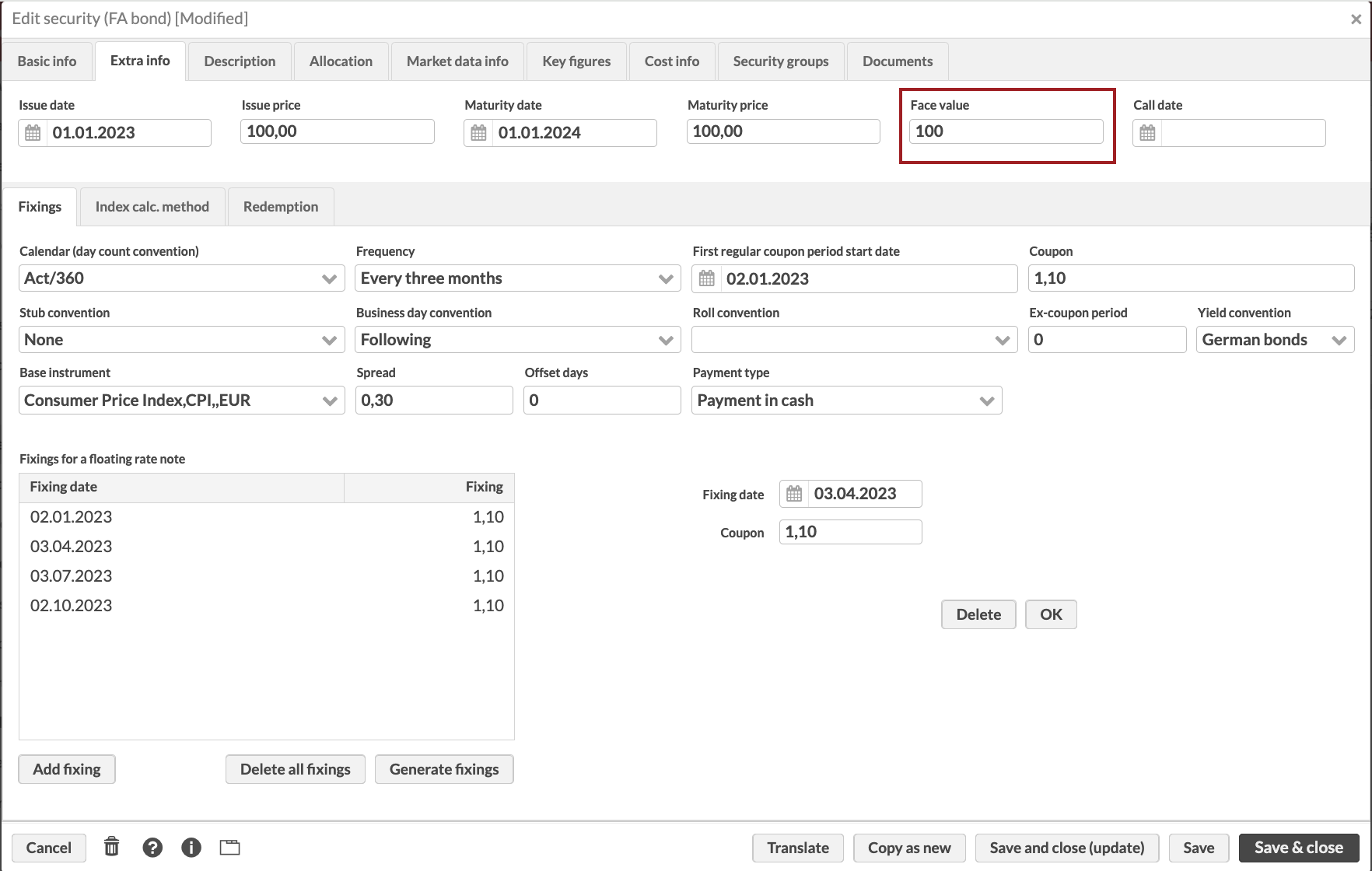

You can now store the face value of a bond in the Security window, Extra info tab. The value is expressed as a whole number. Face value can also be imported with the CSV file for securities.

|

Learn more: Security window, File formats for importing securities and security prices.

Report generation per trade order

Why?

We implemented this feature because users need to trade on behalf of customers and have the system send the trade orders to customers for signing.

Who is this for?

This feature is for users who trade with customer consent or based on their approval.

Details

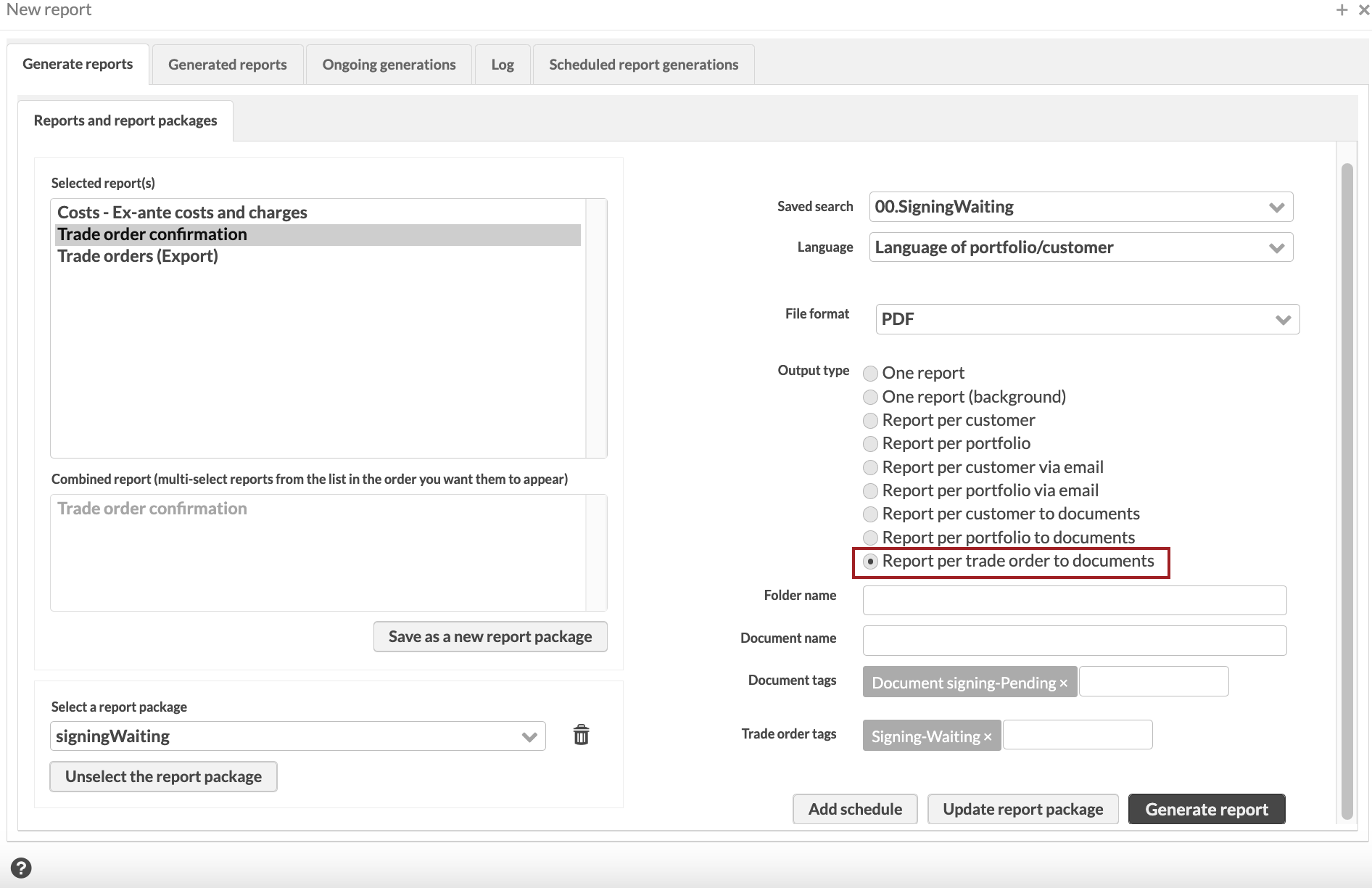

When a user trades on behalf of a customer, the system can now create a pending trade order, send it to the customer for signing, and change the trade order status to executable. In practice, when you select New report in the Trade orders view, we added a new option for the Output type field. The new option allows you to generate reports per trade order directly into each trade order’s documents. When a trade order is created, the system generates a report for it, assigns it a tag indicating that it is pending, and sends a request to the customer to sign via Signicat services. After the customer signs, the system assigns the trade order a tag indicating that it has been signed.

|

Learn more: Report window, Publish reports to documents.

Defining the lots to sell or redeem from

Why?

In some countries, it is common to choose purchase lots to sell when redeeming fund units or other securities, for example for tax planning reasons. We want to allow users to override the FIFO selling order and instead specify the purchase lots they want to sell.

Who is this for?

This feature is for advisors and portfolio managers who create trade orders, as well as for fund employees who manage shareholders' redemptions.

Details

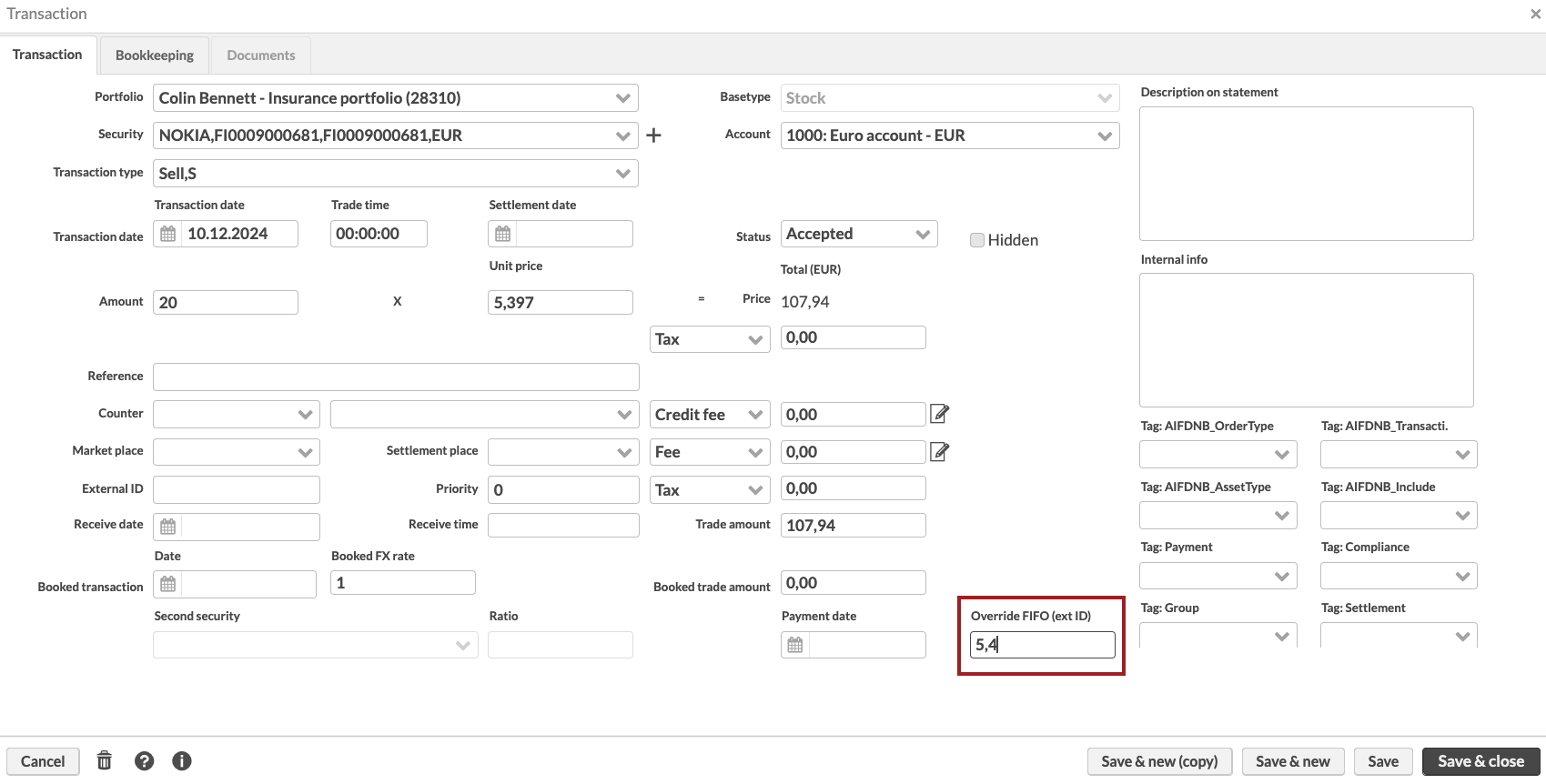

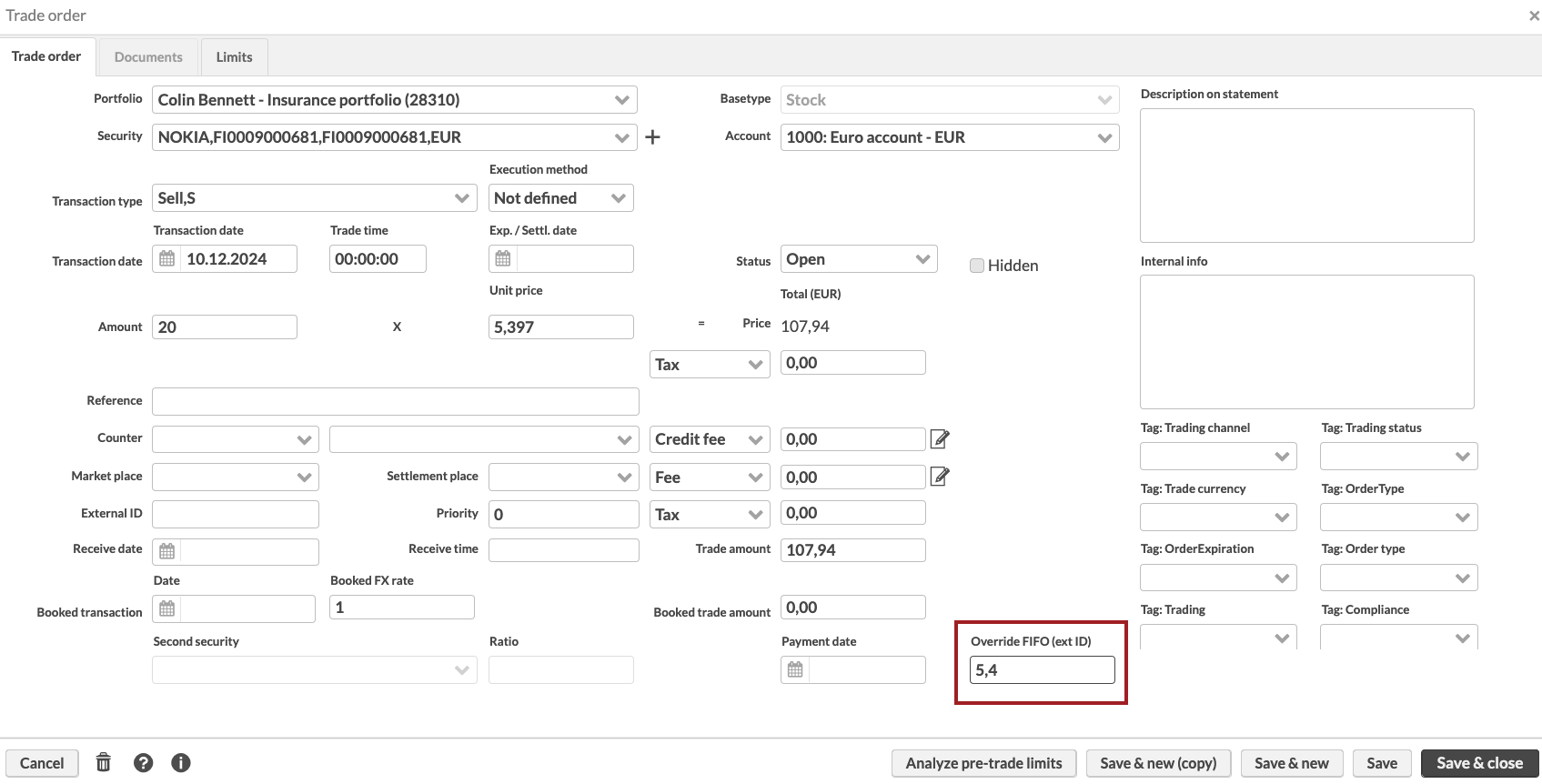

Previously, when selling or redeeming securities, you could override the FIFO order and specify one purchase lot that you want to sell. You can now enter multiple purchase lots and specify the order of purchase lots to sell. To specify the purchase lots, you need to enter external transaction IDs in the Override FIFO (ext ID) field in the Transaction window. We also added the Override FIFO (ext ID) field in the Trade order window so you can now override the FIFO order for trade orders.

When calculating the order of purchase lots to sell, the FA system first sells the purchase lots you specified, and any remaining amount follows FIFO order. You can also override FIFO by importing a list of external transaction IDs in a CSV file of transactions or trade orders.

|

|

Learn more: Transaction window, File formats for importing transactions and trade orders.

Option to define portfolio close date

Why?

Users need to delete or anonymize personal information in closed portfolios to comply with GDPR. To make it easier for users to find closed portfolios, we wanted to add a field indicating the close date of a portfolio. Storing the date allows you to search for portfolios based on when they were closed.

Who is this for?

This feature is for the users who manage portfolios and need to ensure GDPR compliance.

Details

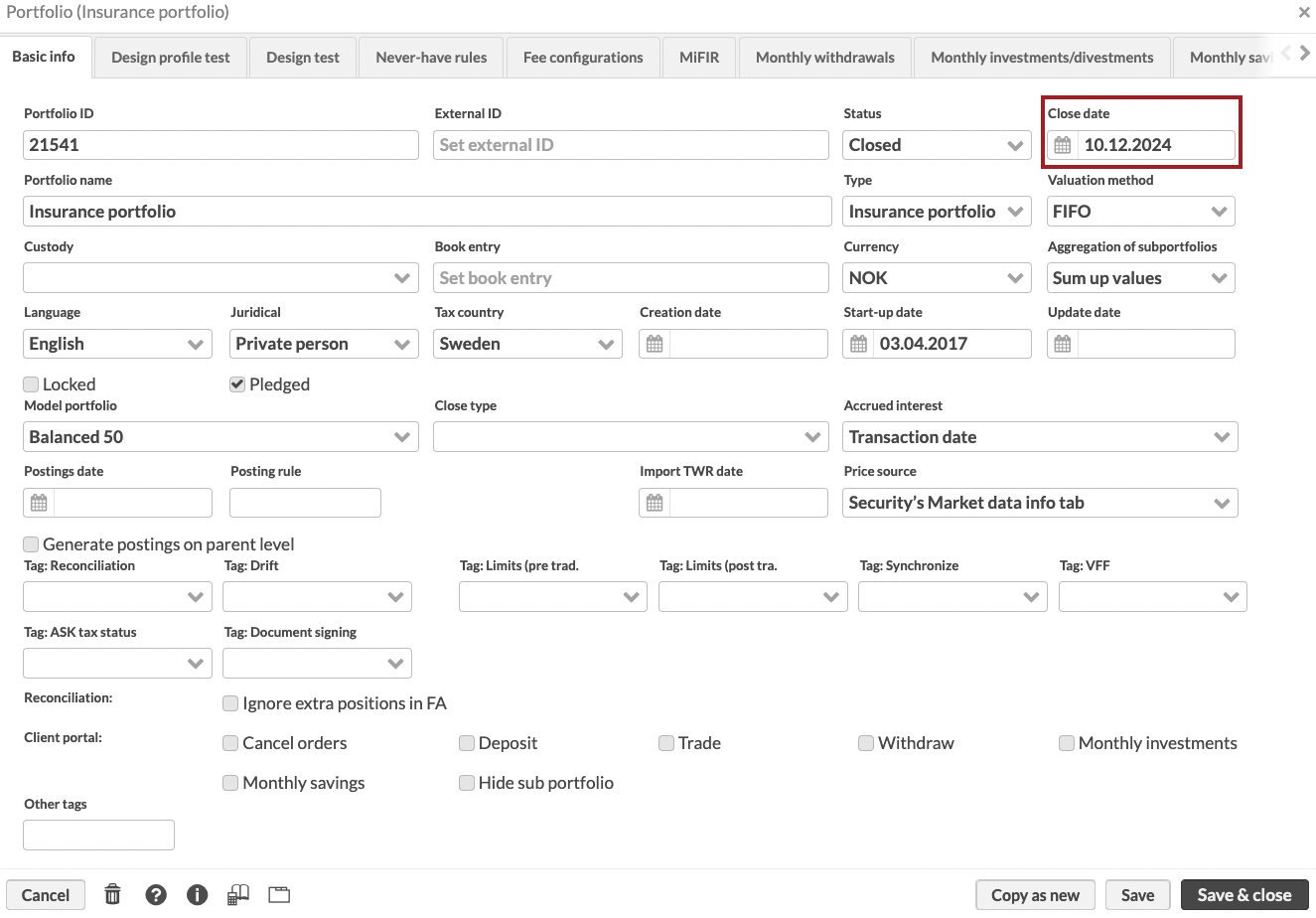

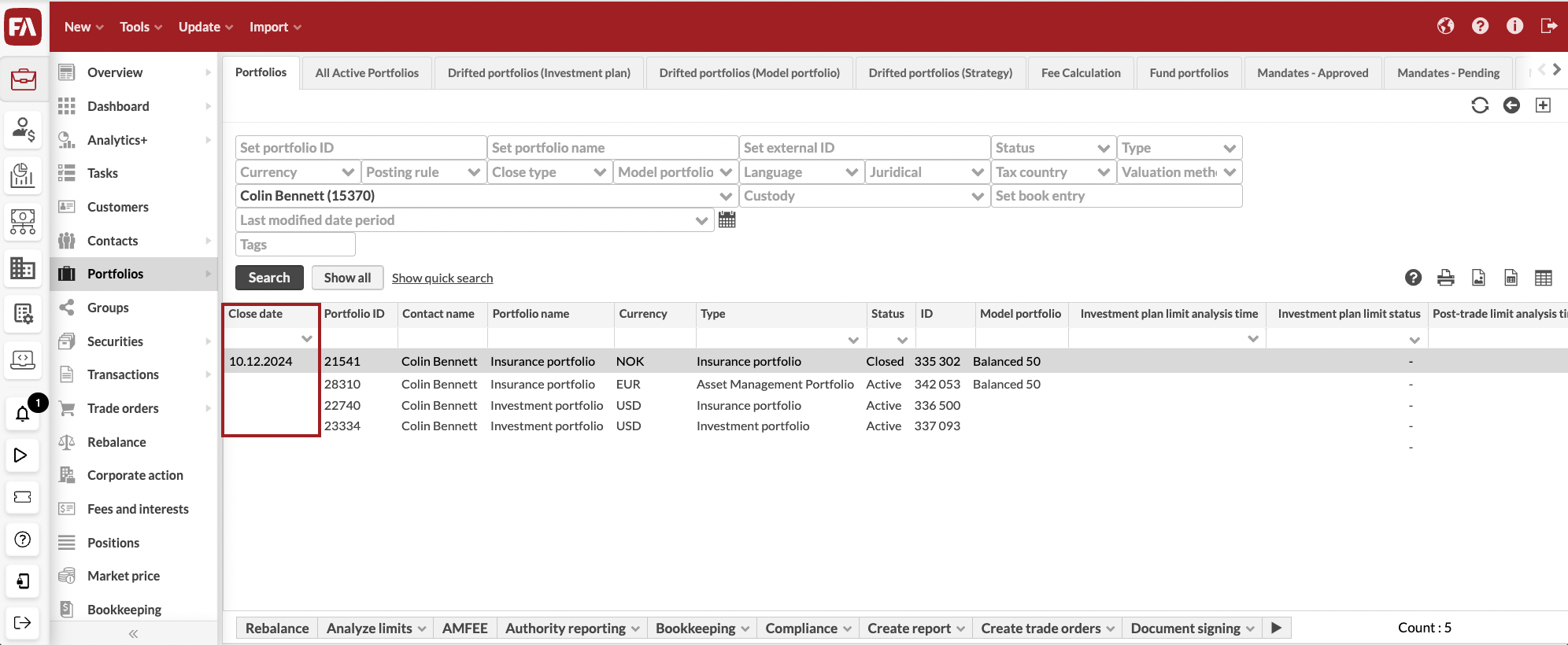

Previously, you could only set the portfolio status as closed. Now, you can also set the close date in the the Portfolio window, Basic info tab. You can also import a portfolio close date in a CSV file.

You can search and filter portfolios by the close date – the Close date field is available as a column in the Portfolios view. This means you can search for portfolios that were closed for a certain time and then delete or anonymize the portfolio information as required by GDPR.

|

|

Learn more: Portfolio window.

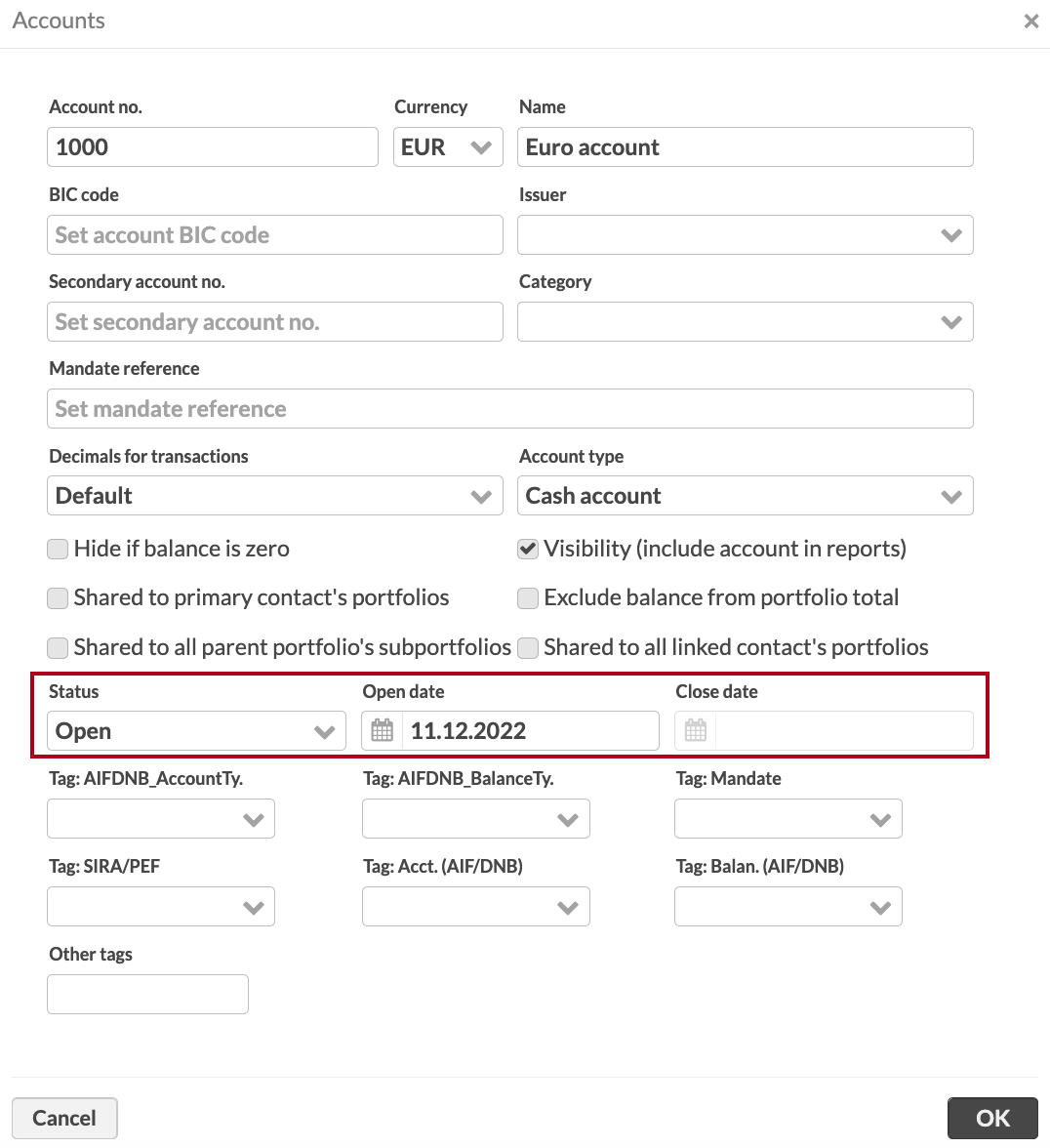

Option to define account status and open and close dates

Why?

Users need to track open and close dates of accounts for regulatory compliance and reporting. For example, UK reporting and CASS regulations require detailed tracking of account status changes, including how many accounts were opened or closed over a specific period. GDPR also requires users to anonymize or delete bank details for closed accounts after a specific period.

Who is this for?

This feature is for the users who manage bank accounts, especially those responsible for regulatory compliance and reporting.

Details

You can track the status and open and close dates of accounts. In the future, we will develop this feature more to show only open accounts when you create new transactions or trade orders. We added new fields for the account status, open date, and close date in the Portfolio window, Accounts tab. New and existing accounts have the open status, but you can change it. You can also change the open and close dates. You can also import the fields to the portfolio in a CSV file.

You can fetch and update the account status, open date, and close date via GraphQL. This allows you to use queries to find out which accounts were opened or closed on a specific date, or how many accounts were opened or closed during a specific period.

|

Learn more: Accounts.

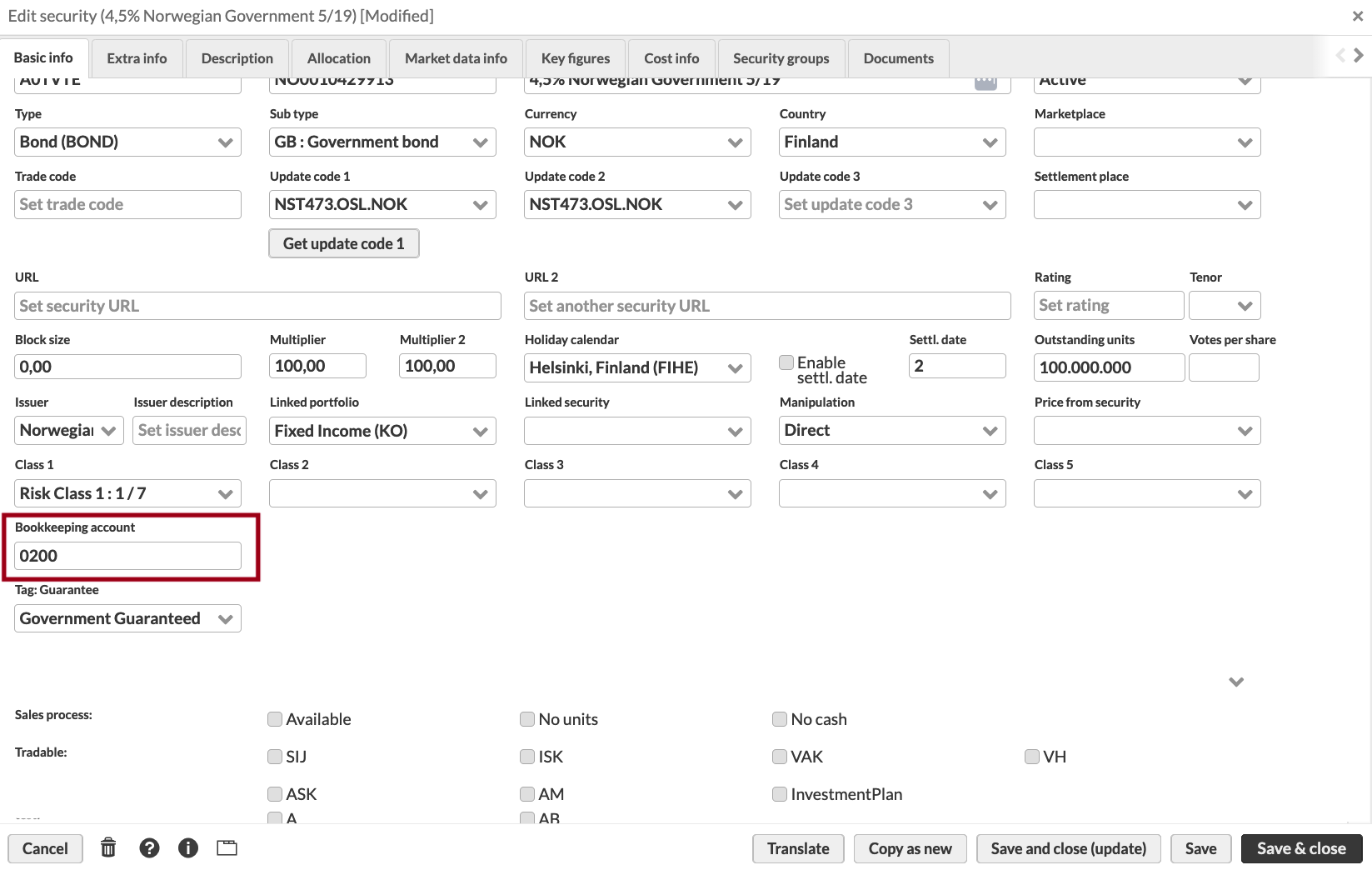

Bookkeeping account field for securities and currencies

Why?

FA Back didn't have a separate field for security’s bookkeeping account. Instead, security’s trade code field was sometimes used to store bookkeeping account numbers. This caused problems in other parts of the system, as you couldn’t use the Trade code field for trade code. Now we added a separate Bookkeeping account field, which makes the setup clearer.

Who is this for?

This update is for users who generate postings with security’s bookkeeping account, and also want to use trading connectors and other features that require security’s trade code.

Details

Starting from this release, you will find the security’s bookkeeping account in the new Bookkeeping account field in the Security window, and security’s trade code in the Trade code field. The values are copied to the correct fields with a script that runs when the new version is installed.

Similar to other security-related fields, bookkeeping account can be entered in the Security window or imported in a CSV file.

|

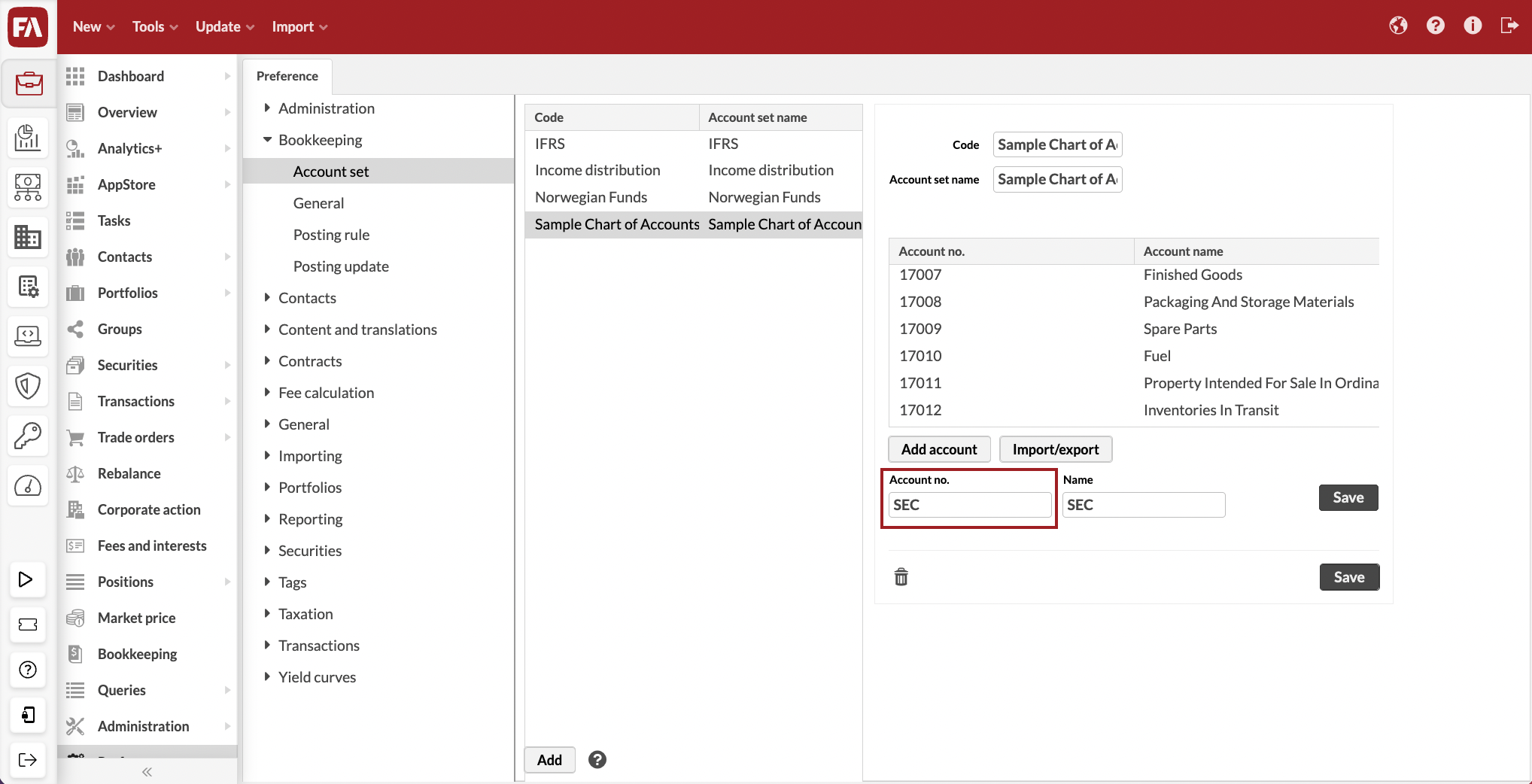

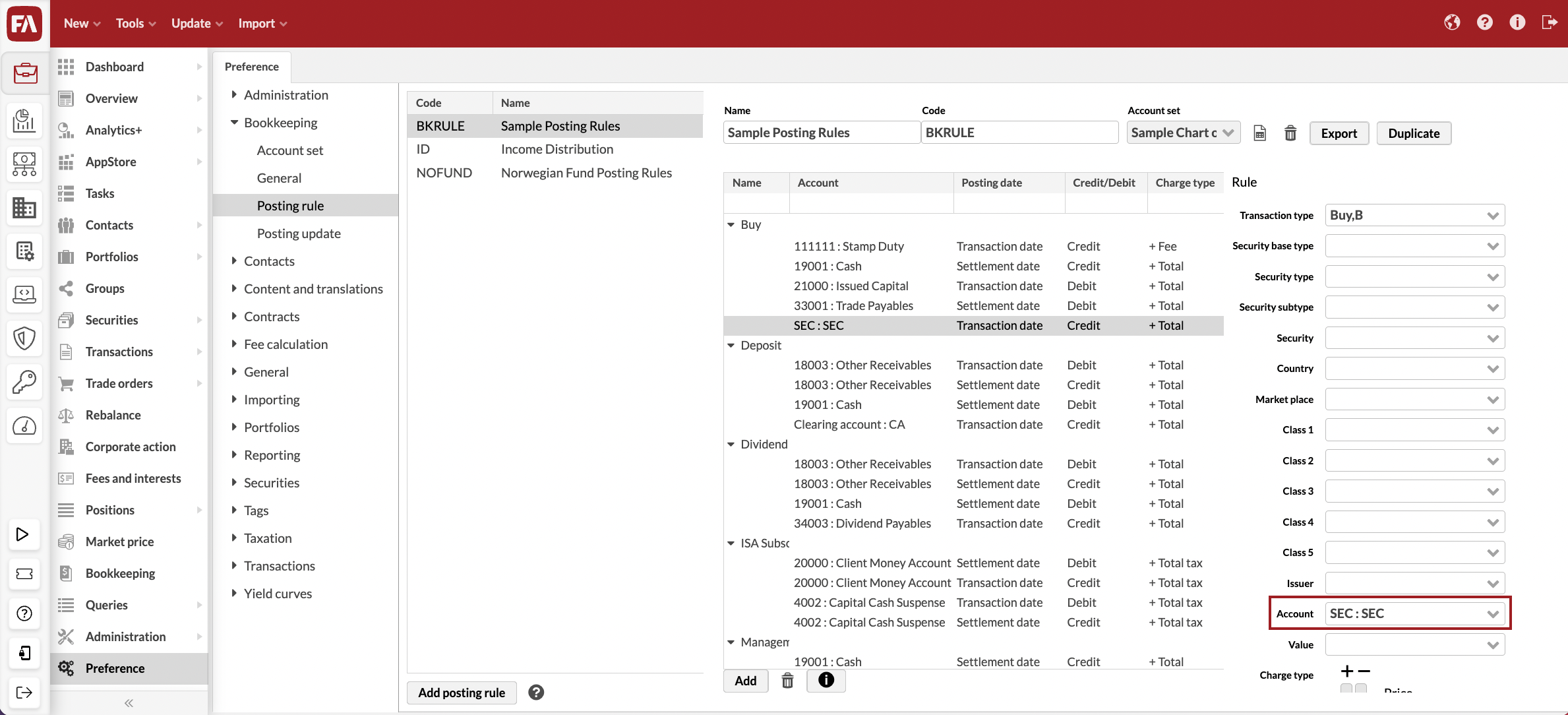

You can use the bookkeeping account of the security or currency to generate postings.

To have the security’s bookkeeping account number in your postings, go to Preference → Bookkeeping → Account sets and configure accounts. Type “SEC” in the Account no field, and link the account to a posting rule (Preference → Bookkeeping → Posting rule). When a posting is generated, the system will fetch the bookkeeping account specified for security and use it in the posting.

To have the currency bookkeeping account number in your postings, go to Preference → Bookkeeping → Account sets and configure accounts. Type “ACC” in the Account no field. and link the account to a posting rule (Preference → Bookkeeping → Posting rule). Make sure the account used in the transaction doesn’t have a secondary account number. When a posting is generated, the system will fetch the bookkeeping account specified for the currency security and use it in the posting.

|

|

Learn more: Security window, File formats for importing securities and security prices, Preference - Bookkeeping.

Other improvements

You can now include the Trade code column in the position row in Analytics+. To do this, you need to configure the column in preferences (see Configuring Analytics columns in Preferences.

Fixes

Accounting

Fixed an issue where saving a deleted transaction caused creation of unnecessary reversal postings.

To ensure consistency across different views, posting rule's name is now displayed instead of its code.

Administration

Changed the logging level for clicks on tree-type menus in preferences.

Analytics

Fixed an issue where the portfolio benchmark was not producing the same indexed return results as the tracked portfolio.

APIs

GraphQL tradeOrders endpoint parameters (portfolioId, portfolioIds and securityCode) now work correctly and return the data.

Removing contact's representatives via GraphQL does now also removes the representative tags from the removed representative.

Authentication

Future-proofed FA Back's authentication and session management.

Corporate actions

Fixed an issue in the Corporate actions view. When viewing an already executed corporate action, default tax rate rows are now displayed as read-only.

Model portfolio management

Rebalancing setting in preferences “Define how much negative cash balance is increased by to cover all negative cash” now works correctly.

Portfolio management

Fixed an issue that prevented defining intra-day lot priority for transactions with the same book date.

Fixed an issue that prevented defining intra-day lot priority on same-day opening transactions when using mergers and exchanges.

When creating a static group, searching among Chosen securities or Chosen portfolios doesn't anymore affect the list of items to include in the group when you click Save. Before, only matching search results were included in the group.

Fixed an issue that occurred when importing updates to a bond with changes to details such as issue date and price, maturity date and price, call date, parameters in the Fixings tab, or fixing coupons' dates or amounts. The report calculation is now correctly triggered in relevant portfolios, starting from the earliest transaction date of the security position.

Fixed an issue where updating a contract (for example, changing the contract date) caused the contract to be saved twice, which resulted in excessive log entries.

Fixed an issue where some transactions sometimes disappeared temporarily from the Transactions view after executing corporate actions or fees.

Portfolio versions now open for portfolios created in FA Back before 3.18. This issue appeared in FA Back 3.24.

Other

Columns included in Standard solution profiles are now consistently visible in the column picker across different views and persist after each Standard solution upgrade.