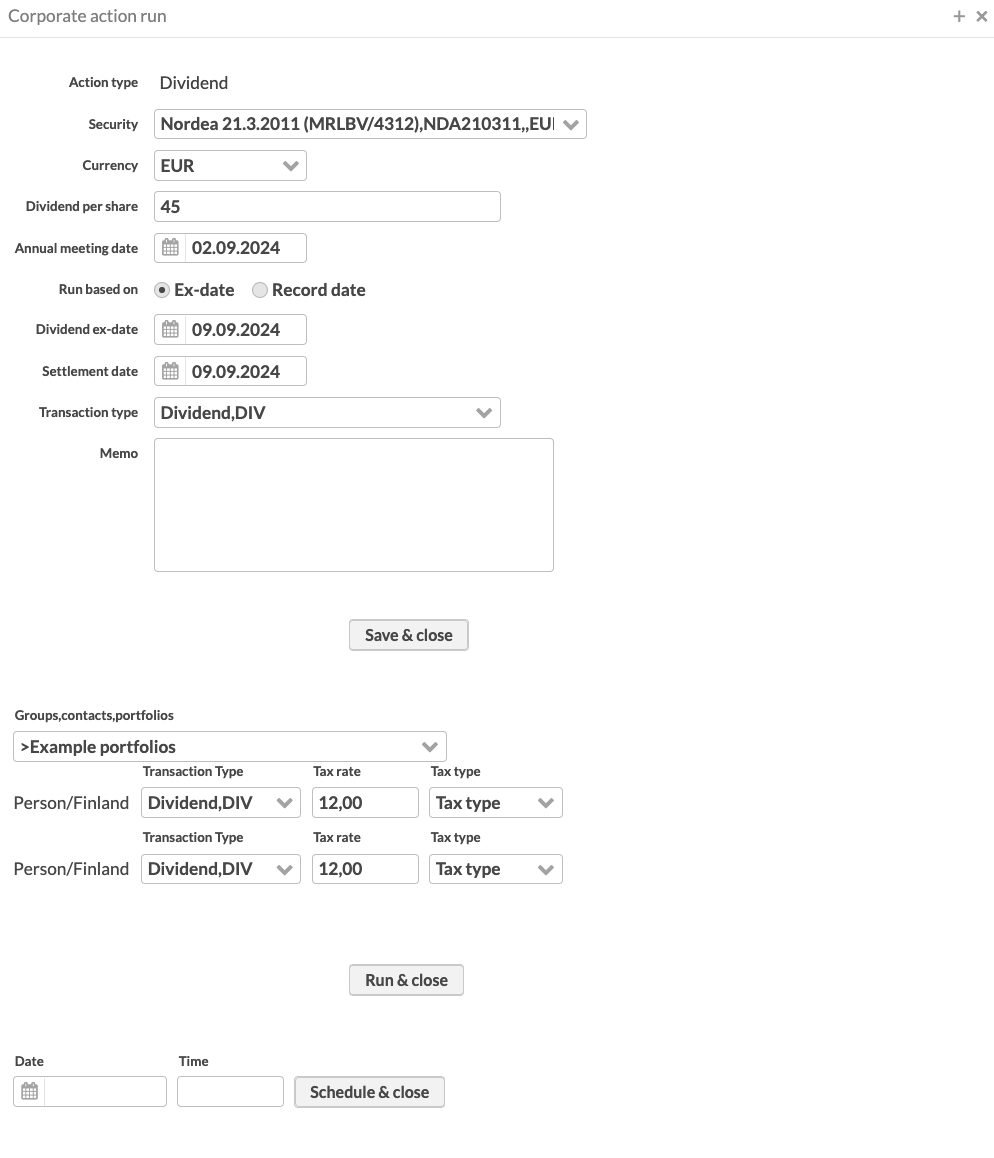

Corporate action window

In the Corporate action run window, you can do three things: define the corporate action information, run the corporate action to selected portfolios, or schedule the corporate action to be run on a future date. The Corporate action run window also allows you to save the corporate action after completing each section so you can close it and return to work on it later on.

For step-by-step instructions on creating, defining, and running corporate actions, see Record and run corporate actions to client portfolios in FA User guide.

|

Corporate action

The fields you need to fill in to define a corporate action depend on the selected corporate action type. For all corporate action types, you need to define the security and transaction type to use, and then define the relevant values, dates, and memo. To learn about the fields specific to each corporate action type, see Corporate action types in FA User guide.

Corporate action run

A corporate action run is defined in the fields below the corporate action information. The following fields are available (fields marked with * are required):

- Groups, contacts, portfolios*

The portfolios you want to run the selected corporate action to. You can run a corporate action to all portfolios (visible as #All), a group of portfolios (visible with Group name), a specific customer's portfolios (visible as Customer name (ID)), or a single portfolio (visible as Customer name - Portfolio name (ID)). The system creates transactions in the portfolios included in the selection. For example, dividends are recorded only in portfolios within the selection containing the dividend security.

- Juridical form/tax country (for example: Private person/Finland)

Tax rates per juridical form and tax country of the portfolio's primary contact. You can set the tax rate for each combination in the list. If you have default tax rates set in Preference → Taxation, the system suggests them in the list as well. Setting default tax rates in Preference is recommended – this makes it easier to use the tax rate across the system in transactions and corporate actions. Defalut tax rates can be set for more granular combinations that include, for example, portfolio type and portfolio tags in addition to the contact's juridical form and tax country. To set the default tax rates, see Preference - Taxation.

Define the following to apply the tax:

Transaction type - Transaction type of the transactions created based on the corporate action. By default, the system suggests you use the same transaction type you selected in the corporate action information. You can change the transaction type for certain combinations. For example, you can create transactions of a specific type for private persons in Finland.

Tax rate - Tax rate to use in transactions.

Tax type - Tax type to use in transactions.

- Exchange rates

The exchange rate if the security currency of the corporate action and the portfolio currency are different. Define the exchange rate of the portfolio's currency against the security currency. The field is available for all combinations of the security and portfolio currencies related to the run, and you can define each exchange rate separately. The format of the field is the following: Portfolio currency/Security currency (for example: EUR/USD). To fetch the exchange rate automatically, enter a question mark (?) in the field. The system sets the exchange rate as the market price of the currency on the day of the corporate action. If no market price is found for the date, the system uses the latest available market price.

Scheduled corporate action run

A corporate action is scheduled for a future date in the fields below the corporate action run information, and the system automatically performs the run. When scheduling a corporate action, you do not know, for example, the exchange rate. During the run, the system uses the latest FX rate from the market price entries of the currency to ensure that the corporate action is converted with an accurate exchange rate. The following fields are available:

- Date

The date you want the corporate action to run on. A corporate action should not be run before the corporate action date or before all transactions in the selected portfolios are in the system to ensure the corporate action runs against accurate data.

- Time

The time you want your corporate action to run on, specified in the format HH:MM. Running a corporate action generates transactions and triggers report recalculation which might take time for a large number of portfolios.

Example:

You receive information of a dividend on September 20th, and the dividend will be paid on November 11th. When scheduling the dividend in September, you do not know what the FX rate is in November. When running the corporate action in November, the system fetches the latest FX rate from the market price entries of the currency to ensure that the corporate action is converted with an accurate exchange rate.

Transactions from a corporate action run

Running a corporate action creates transactions in the selected portfolios based on the position of the corporate action security on the morning of the corporate action date (meaning the position after the previous day's transactions) and the information defined in the Corporate action run window. The system only creates transactions in portfolios that own the corporate action security on the morning of the corporate action date. The transactions cause the corporate action to show up in the affected portfolios.

The system automatically determines the account for the transactions when running the corporate action. If the transaction type you defined in the Corporate action run window has a cash effect, the following logic is used to set the transaction account:

If the portfolio has an account with the same currency as the corporate action security, it is set as the transaction account.

If no portfolio account is found with the same currency as the corporate action security, the portfolio's default account is set as the transaction account.

If the portfolio has no accounts, the shared accounts of the portfolio are used with the same logic: If found, the shared account with the same currency as the corporate action security is set as the transaction account. If no such shared account is found, the shared default account is used instead (from FA 3.5 onward, corporate action run also considers accounts shared through the "Shared to all linked contact's portfolios" option).