Pay out fund dividends

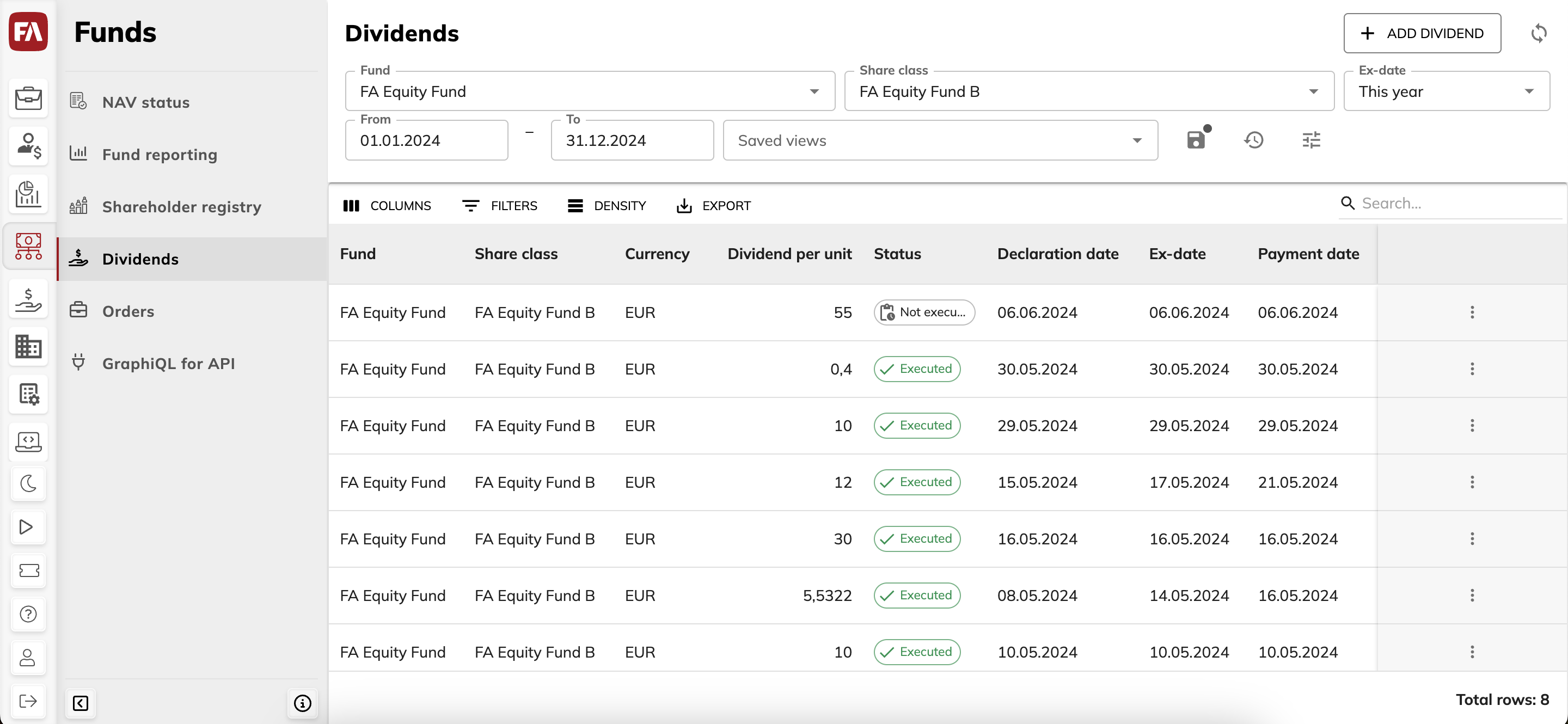

In the Dividends view, you can see the dividend history and create, execute or edit dividends or dividend transactions. To enable dividend payments for a fund share class, open the Share class wizard, Basic info tab and select the Enable dividend payments option (see Add share classes).

Note that while you can run dividends based on the record date in FA Back, the Dividends view doesn't show them (see Dividend in FA User guide).

|

Viewing options

You can:

Refresh the table content by clicking

at the top right.

at the top right.Export dividends as an XLSX or CSV file.

For the whole table, click Export → Download as CSV/XLSX.

For specific dividends, select rows and click Export → Download as CSV/XLSX.

Adjust the table (see Adjust the view) and group the table information by certain columns (click on

and then Group by).

and then Group by).

Adjust the view

You can adjust the table layout and specify the search criteria and then save these modifications for later:

Make your adjustments. You can:

Adjust columns.

Show or hide columns (

).

).Reorder by dragging and dropping.

Change the width by dragging the boundary.

Sort by clicking the column name.

Adjust table row density (

).

).Filter the table based on column content (

).

).Search the table with the search fields at the top of the view.

Click

and enter a name for the view.

and enter a name for the view.Click Save.

The adjustments are saved as a view, including the search fields at the top. You can now:

Set a saved view as the default. To do this, click the Saved views field or

, and then click the star icon

, and then click the star icon  next to the saved view.

next to the saved view.Open a saved view, work with it and make changes to it, and then use

to restore the view to its previously saved settings.

to restore the view to its previously saved settings.Clear the saved view and return to the initial system view (click

in the Saved views field).

in the Saved views field).Rename or delete saved views (click

to open the saved views sidepane).

to open the saved views sidepane).

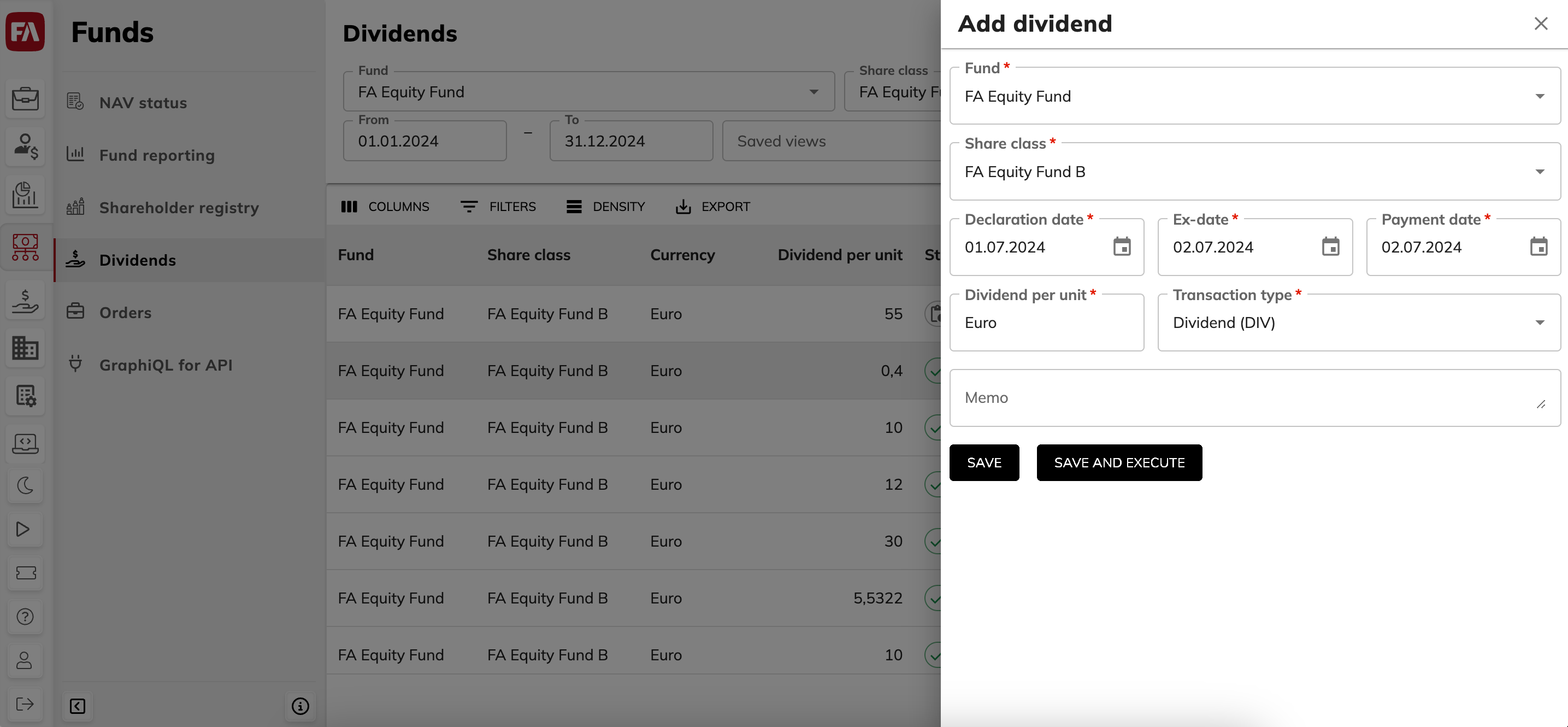

Create and execute a dividend

To calculate dividends and create dividend transactions in the shareholder portfolios, follow the steps:

Open the Dividends view.

Click Add dividend in the top-right corner of the view and fill in the fields:

- Fund

The fund that pays the dividend.

- Share class

The share class that pays the dividend.

- Declaration date

The date when the dividend payment is announced.

- Ex-date

The dividend ex-date. The dividend is calculated based on the number of share class units in the shareholder's portfolio on the morning of the ex-date (the position after the previous day's transactions). This date will become the transaction date of the created dividend transaction. When you calculate NAV on the ex-date, the dividend isn't anymore included in NAV.

- Payment date

The payment date of the dividend, when the dividend is actually paid to the shareholder. Payment date becomes the settlement date of the created dividend transaction.

- Dividend per unit

The dividend to pay per share class unit.

- Transaction type

Transaction type to use for the dividend transactions. By default, FA Fund Management uses the Fund dividend (FMDIV) transaction type.

- Memo

Memo note for the dividend.

If the dividend execution date is today, proceed to executing the dividend by clicking Save and execute.

Alternatively, save the dividend and execute it later (click Execute in the Dividends view).

Check the tax rates and FX rate in the Dividend view that opens. Click Execute to generate dividend transactions. The dividend status changes to "Executing", and then to "Executed" in the Dividends view. You can view the dividend transactions by double-clicking the dividend.

|

As a result, FA Fund management does the following:

Creates dividend transactions in the shareholder portfolios.

Creates a cashout transaction (FMDWD type) to take out the dividend amount from the fund portfolio. Next time you calculate NAV, the total dividend amount is excluded from the calculation.

You can ensure that all shareholders received dividends by clicking Reconcile in the Dividends view. The system shows a confirmation message that reads "Dividend transactions are created for all shareholders".

Edit dividends or dividend transactions

You can edit an unexecuted dividend by doing the following:

For the dividend you want to modify, click the

icon and select Edit.

icon and select Edit.Make your changes in the side pane that opens.

If you want to proceed to executing the dividend, click Save and execute and fill in the tax rates and FX rate. If you want to execute the dividend later, click Save.

You can cancel dividend transactions for executed dividends, for example, if you notice that some tax rates are incorrect or if the error is due to incorrect positions in shareholder portfolios. To cancel dividend transactions, do the following:

Double-click an executed dividend in the table.

Select the dividend transactions to delete and click the

icon.

icon.If needed, make corrections in the shareholders' portfolios.

Click Reconcile next to the dividend in the Dividends view and confirm that you want to execute missing transactions (Execute).

Enter the correct dividend parameters (you can only correct tax or exchange rates that are not used in any transactions) and click Execute.

Dividend transaction properties

For executed fund dividends, the following information is available in the Dividend transactions view when you double-click a dividend row:

- Portfolio

Shareholder's portfolio.

- Shareholder

Shareholder name.

- Units

Amount of dividend units.

- Dividend (currency)

Amount of dividend assigned to the shareholder in the fund currency.

- Tax country

Shareholder's tax country.

- Tax (currency)

Amount of tax on the dividend amount in the fund currency.

- Amount paid (currency)

Amount of dividend paid in the fund currency.

- Amount in account currency

Amount of dividend paid in the shareholder's account currency.

- Account currency

Shareholder's account currency.

- FX rate

The FX rate used.

- Run time

Run date and time of the fund dividend payment.